A rapidly shifting economy can destabilize businesses in every sector, and that includes the banking industry. Attempting to balance customer (or member) expectations with variables like rising interest rates, unpredictable regulatory environments, technological advancement, and possible economic stagnation can be a tremendous challenge for banks and credit unions who are looking to grow.

Optimizing the budgeting and planning processes by focusing on the effectiveness, efficiency and agility of those processes is critical in this rapidly evolving environment. To achieve the goals of your organization and meet the needs of your customers, you must assess obstacles, adopt new strategies, and develop a clear picture of your abilities and aspirations. No matter how faithfully your tried-and-true planning methods have served you in the past, it’s worth carefully examining them for their efficacy going forward.

In this article, we’ll provide a clear view of how the planning and budgeting processes should evolve at banks and credit unions, while specifically identifying a few areas to focus on to maximum the value of the overall planning processes.

Evolution of the Planning Process

As you look to improve the planning processes at your institution, it’s important to take a holistic view of your organization’s operational and financial strengths, weaknesses, and sensitivities, in order to best understand what deserve the most attention as you develop your plans. This requires viewing our planning processes as part of a larger performance management cycle.

Continuous Performance Management Cycle

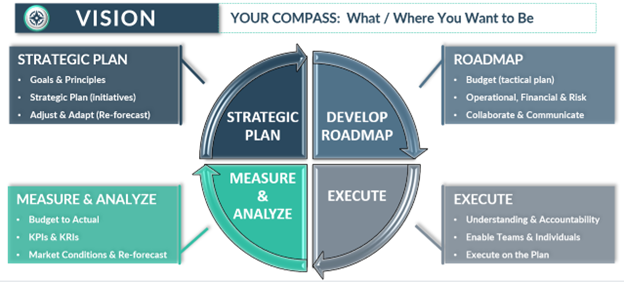

Transforming the planning process within your organization must become a top-down endeavor. Begin by aligning your strategy with your overarching vision and creating consistency in your processes. Once this is complete, you’re ready to begin working within the Continuous Performance Management Cycle detailed below.

- Build a strategic plan, with a set of measurable goals, projected growth assumptions, and expected financial impact.

- Develop a more tactical “roadmap”, or budget, where you take into account operational needs and assess both financial performance and risk.

- Communicate the finalized budget and related plans throughout the organization, allowing department managers and teams to execute upon the plans, while keeping them accountable.

- Measure and analyze the success of the plans you’ve implemented. Assess financial targets against actuals, gather feedback from leaders at every level, and re-forecast based on both internal factors (changes in your organizational focus, operational capabilities, financial performance to date, etc.) and external factors (customer demands and expectations, economic and market updates and expectations, etc.). Repeat the process.

Keys to Success

Every bank and credit union are unique. Your institution should analyze and understand the areas and metrics that are most impactful to its overall performance and ability to achieve its goals, and then spend the most time, energy and focus on those areas in the planning process. For example, an organization that is highly dependent on net interest margin as a driver of performance should focus on the balance sheet and margin planning processes. While an organization that is trying to increase or maximize their non-interest revenue and fees, may want to focus on operational strategies and plans to drive fee-based business.

There are, however, many best practices that apply to the planning process that are applicable to every institution. Once you’ve identified the areas of focus for your organization, abiding by the best practices below will help ensure that you address them as quickly and efficiently as possible.

Collaboration

Most organizations are composed of so many moving parts and functional areas that it can be hard to organize effective strategies. When developing your budgeting process, it’s important to rope in leaders from every department to ensure that their needs are being addressed.

Your functional line of business (LOB) or market managers will all have unique insights to share, and it is imperative that they are given an opportunity to provide them in one fashion or another. Some of those insights may be best learned through a meeting, where you can discuss the impact they can have going forward. Others may be best communicated through data and shared through emails or spreadsheets; while other areas may be best served by directly inputting their growth and expense assumptions into the planning system itself (supporting the concept of decentralized budgeting).

An additional area of collaboration that is typical, but often not optimized for efficiency and/or accuracy, is collaboration between your Finance / Accounting area, and your Treasury / ALM area. The balance sheet and margin planning process are very similar for ALM and risk purposes and for budgeting and planning purposes. However, in the budgeting and planning process, organizations often want to bring their growth plans down a level, to account for differences in LOB, market, or even branch level growth assumptions. Enabling efficient mechanisms to share data and assumptions, such as interest rate forecasts, prepayment speeds, credit assumptions, etc.) between your ALM and your budgeting and planning systems / processes, while still enabling unique growth and spread assumptions at the LOB, market, or branch levels specifically for budgeting purposes can increase the precision, consistency and efficiency in your overall balance sheet and margin planning.

The key point is this: you want the right people planning the right areas. Allowing them to have input on their area of expertise will give you the most comprehensive knowledge to go forward with.

Sub-Ledger-Level Planning

When creating your budget, it’s easy to look at certain expenses and make large cuts in an attempt to run more efficiently. In many cases, though, these bird’s-eye views of expense accounts do not accurately reflect their necessity. For most institutions, taking a more granular approach, wherein each area of focus is dissected and examined closely for improvements, ends up being more impactful.

For example, a bank whose second largest non-interest expense account is software and data processing may benefit from planning by vendor level rather than at the GL level. This would allow them to plan effectively going forward, make decisions about contract renewal, needs for those services, opportunities to find other vendors, etc.

Forecasting

Markets, your business, your customers and their expectations will change. Reforecasting allows you to adjust your strategy and set new expectations for your business, in turn allowing you to adapt to circumstances more quickly.

Remaining agile in the planning process is crucial to maintaining balance on uncertain ground. This may mean reimagining your organization’s sources of revenue, devoting more effort to diversifying product offerings, or simply taking a closer look at your margins. Taking time to forecast on a quarterly or even monthly basis will keep you nimble and flexible when it matters most.

Scenario Analysis

Your budget is subject to many variables outside your control. If you only ever plan according to the best-case scenario, you leave yourself and your organization vulnerable to change. If you only plan for the worst-case scenario, you’re potentially leaving growth and earnings on the table.

This is why we strongly recommend performing scenario analysis. With a balanced view of possible economic situations, you can understand their potential impact on your growth, balance sheet structure, and Key Performance Indicators (KPIs), ultimately leading you to better outcomes for your organization and better returns for your customers.

Tie Back to Strategy and Vision

When your planning process is tightly knit to your overall vision and strategy, it leads to greater organizational strength and competency Your plan should support your organization’s goals for the next 2-5 years, and you should constantly communicate your vision, goals and plans throughout every level of the organization.

The Big Picture

Updating the way in which you not only view but execute your budgeting and planning processes will have major impacts on the success of your bank or credit union over the coming years. With continued political, economic, and social uncertainty, fortifying your organization by reevaluating your processes will help ensure that you continue to grow and provide value for your institution’s stakeholders long into the future.

As always, Empyrean remains dedicated to seeing our partners thrive by providing targeted solutions that address their individual needs. If your organization needs help from someone who’s been there before, contact us today, and let us show you what a true technological partner can do.