The COVID-19 pandemic combined with U.S. fiscal and monetary responses creates a cauldron of potential future economic scenarios which are causing unprecedented challenges for financial institution (FI) managers working to prepare 2021 plans. These managers need to move away from traditional practices which consider a limited range of scenarios and strategies as they develop their 2021 plans.

To develop meaningful annual plans with appropriate contingencies in this environment requires modeling which explores a wide range of potential future environments. This planning approach combines business line aspirations with quantitative perspectives on how FI results are impacted by varying environmental factors. This is a scenario analytic approach which evaluates a wide range of balance sheet and income strategies and outcomes to gain insights to support 2021 planning decisions.

What’s Different from Prior Years

The economic fallout from the coronavirus is the second “once in a hundred years” financial event in the early innings of this century. However, the current situation is very different than the Great Recession in many respects. Most agree that the primary causes of the Great Recession were a combination of relaxed mortgage market credit standards, extensive use of financial derivatives to disperse the risk from these instruments, and, on a relative basis, weak financial institution balance sheets. Once the recession started it was clear that the global financial infrastructure was at risk of imploding. In response, the Federal Reserve, Treasury, and other global government actors developed new tools to meet these challenges. As a result, the fall in economic activity and the responses to mitigate this drop unfolded over a period of years.

This time the downturn occurred in a period of weeks as the country shut down, causing a massive spike in unemployment. The Federal Reserve, Treasury, and Congress recognized the severity of the situation and, in the case of the Fed and Treasury, immediately unleashed tools that were on the shelf and ready to go from the Great Recession. Also, FIs started in much stronger shape than before and there is unlikely to be concern that the financial system will freeze up.

The rapid government responses have resulted in postponing fallout from Depression-level job losses by protecting individuals and businesses in some form through the end of the year. Thus, massive job and income losses have not resulted in immediate hits to the credit quality of FI loan portfolios. At the same time, flooding the economy with money as evidenced by the increase in Federal Reserve assets, now at approximately $7 trillion, provides a potential powder keg of latent inflation-driving resources if the economy does recover quickly in 2021.

This tug-of-war between impending credit losses and the mitigating actions of government makes establishing a baseline planning environment for 2021 much more difficult than in prior years. There is the possibility of huge government stimulus driving a rapid rebound in economic activity with concomitant reductions in expected credit losses. Conversely, there also is a high probability of limited or no further government stimulus combined with a strong rebound of the coronavirus resulting a in severe drop of economic activity and higher than expected credit losses.

Why Build a Scenario-Based Business Plan?

These disparate scenarios cause very different earnings and balance sheet outcomes for which management should prepare alternative business plans reflecting these differences. Traditional planning processes and supporting models are not designed to absorb this much variation and produce meaningful business plans. Scenario-based planning can rescue us from this situation providing several valuable benefits.

Scenario-based planning:

- Examines and develops plans for wide variations in environments which provide insight into the range of potential earnings outcomes that could occur. It shows the effects of complex relationships across net interest income and non-interest income accounts impacted by interest rate and macroeconomic drivers. Given the accounts often are in separate business units, having a consolidating way to evaluate how these accounts behave is critical to identifying and, potentially mitigating, correlated impacts

- Can incorporate quantitative guardrails that challenge business line expectations when modeled results do not align with business line projections. This practice at many FIs evolved from CCAR and DFAST practices where business line financial plans were challenged by market realities identified in quantitative models of these plans

- Fosters formalized evaluation of key risks, risk drivers, and relationships which are the basis for a living plan with embedded contingent actions built in to respond to alternative economic environments. Like managing a sports team, having playbooks ready to respond to what the environment presents should result in faster and more effective implementation of these responses

- Forms a basis for enhanced Early Warning Indicators (EWIs) by drilling down to key variance drivers. Many FIs have revamped their EWIs this year in response to massive loan and deposit flows into their balance sheets. Revamped EWIs capture quantitative and qualitative information on the state of customers, local markets, and financial markets at a monthly, weekly, daily, and even intraday frequency.

What Should Be in the Plan

Scenario-based plans are going to be most impactful on those line items with the greatest potential variation in outcomes in response to the macroeconomic environment. These are characterized as being beyond management’s control with significant responsiveness to interest rates and the macroeconomic environment. Going into 2021, the line items which fit this description fall into three categories:

- Credit risk driven. Across the entire loan portfolio, success in corralling the coronavirus and the level of government action will shift credit losses significantly. Virtually all FIs have responded to recent events by increasing their loss allowance. The next challenge will be adjusting this allowance up or down through the provision depending on the path of the economy

- Interest rate-driven non-interest income. The largest single factor in this category is mortgage fees for both origination and refinancing of mortgages which are likely to drop significantly if term interest rates increase. The Fed has committed to maintaining low interest rates into the foreseeable future, but their ability to control interest rates decreases beyond short-term rates which opens the potential for curve steepening with increases in mid- and long-term interest rates

- Non-maturity deposit balances have surged since the beginning of the year in tandem with the increase in Federal Reserve monetary stimulus. FIs have been reluctant to deploy these deposits into loans and other non-liquid assets in anticipation of their attriting, particularly in stressed credit scenarios. As FIs gain clarity on the environment going into 2021, deploying these deposits could become a significant contributor to earnings as the year progresses

Building a Scenario-based Plan

There are two primary elements to scenario-based plans—scenarios and plans. Scenarios are the core component of asset/liability models. Historically, these have been exclusively focused on interest rates and how changes in market interest rates affect product yields and rates, balance sheet flows, drivers of non-interest income, and ultimately earnings and capital. Changes in market interest rates are set deterministically or through assignment of term structures and volatilities.

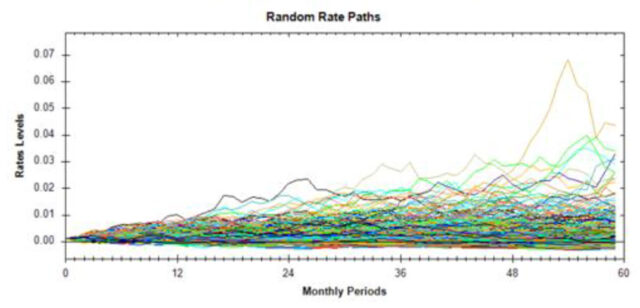

As shown in Exhibit 1, simulation of many rate paths can be created around the baseline forecast. In addition, shocking volatility (i.e., the potential for wider movements in interest rates) expands the range of interest rate paths in the scenarios evaluated.

After the Great Recession, incorporating other factors into scenario modeling became widespread and heavily influenced by regulators as part of CCAR, CLAR, and DFAST stress testing. These annual processes to measure the level of capital and liquidity strength are driven by a combination of interest rate and macroeconomic factors. Scenario sensitive equations from these efforts are increasingly being incorporated into the A/L model which, in turn, provides a framework for evaluating dimensions of risk beyond interest sensitivity.

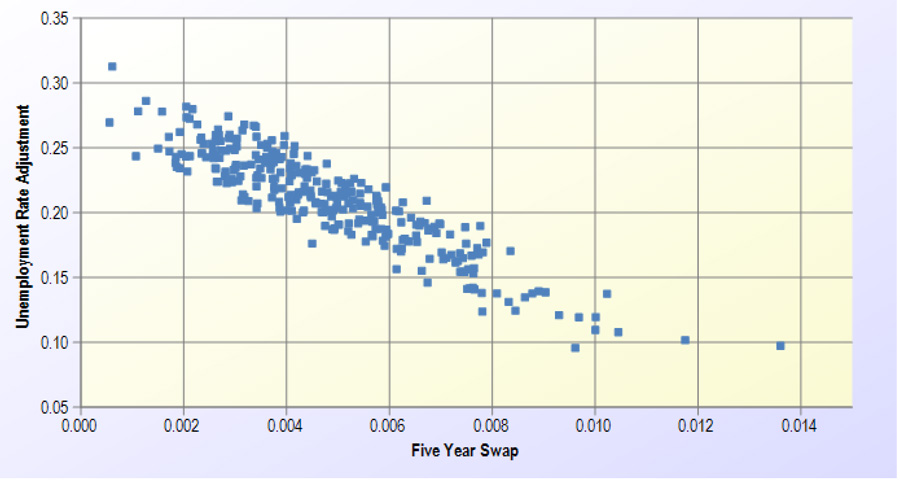

As shown in Exhibit 2, a simulation of the relationship of interest rates and unemployment is shown across 300 scenarios based on simplified assumptions of the estimated correlation of interest rates and unemployment in an evolving COVID environment. This simplified premise is that economic activity will increase in an improved COVID environment, interest rates will increase as monetary velocity increases, and the level of credit losses will fall below expectations. Conversely, failure to control the coronavirus will torpedo economic activity, causing credit losses to be above expectations, and interest rates to collapse further.

There are multiple ways to incorporate business plans into a scenario-based approach based on interest rate and macroeconomic drivers. Business line managers often establish baseline plans with sensitivity of these plans to varying environments shown in the form of change factors responsive to the interest rate and macroeconomic drivers. Equations and lookup tables are effective approaches for getting these change factors into the A/L model and provide the basis for getting insights from results in varying environments.

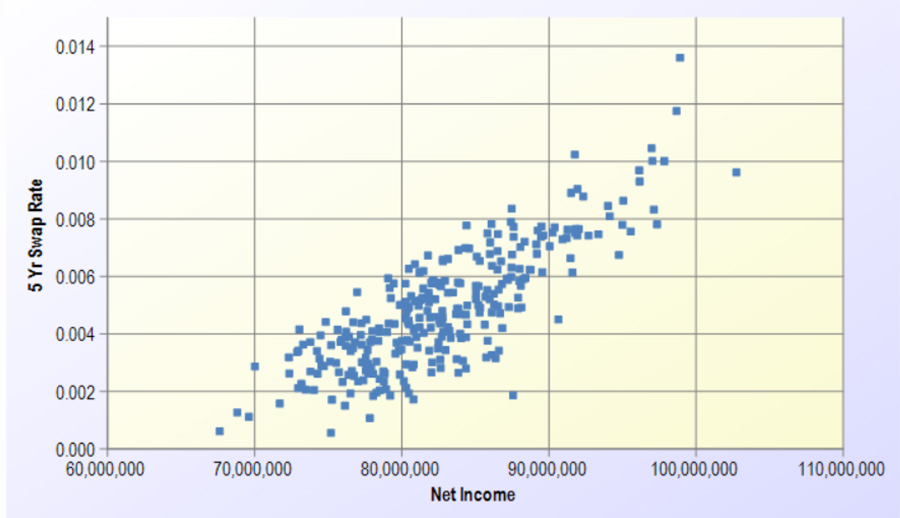

With these baseline forecasts and driver relationships established, FIs can develop nuanced understanding of the range of potential outcomes in 2021. In Exhibit 3, net income has been simulated in 300 scenarios. Net income is shown to be positively correlated to interest rate levels using the equations which incorporate interest rate and macroeconomic drivers and correlations. Application of these equations resulted in a largely inverse relationship between interest rates and unemployment resulting in the distribution of net income in the graphic in Exhibit 3. One aspect of using a simulation approach to planning is that each run can be drilled into to identify and analyze the drivers of the outcomes. These drilldowns can provide insights into exposures (or opportunities) which are not always apparent in simple parallel shock and ramp scenarios.

What to do with Results

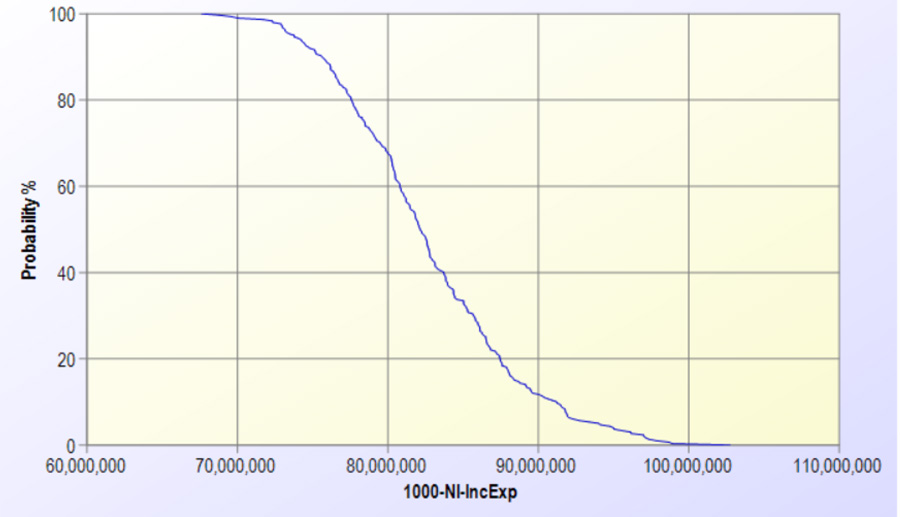

Mitigation strategies can be developed based on the quantified impacts of the drivers of earnings volatility. Running and assessing many scenarios is most valuable when insights gained from the scenarios are actionable. As shown in Exhibit 4, scenario analytics can create a profile of earnings outcomes. Detailed analysis described above provides the information needed to understand how this distribution of earnings occurs and in what environments. These insights provide the basis for taking mitigating actions designed to move the top half of the curve to the right (i.e., improve poor outcomes).

That is, from a balance sheet management perspective there are trade-offs available which will mitigate downside exposures while maintaining or increasing the average expected outcome. These situations can be categorized as:

- Low cost insurance. When a balance sheet income-driven statement exposure is opposite of what the market expects, the cost of hedging can be very low. This was the case pre-pandemic when rates were rising, and the market had assigned a very low probability of interest rates going down, thus making the cost of floors very low. The current situation where the market is assessing very low probabilities of term rates going up may be similar.

- Contra-correlated outcomes across risk drivers. This occurs when interest sensitive earnings are impacted differently by different parts of the yield curve, creating hedging trade-offs. Alternatively, credit risk may be negatively correlated with interest rates creating opportunities to mitigate credit loss impacts with balance sheet positioning which highlights another reason for running scenarios of income items and not just net interest income items.

Concluding Comments

Periods of extreme macroeconomic turmoil like what we are currently experiencing call for processes and tools which can support the exploration and response to widely varying scenarios. The range of financial outcomes stemming from the annual plan can be improved upon and narrowed by expanding the number of scenarios explored and developing strategies that work with these scenarios. In addition, macroeconomic and interest rate drivers of results can be incorporated into the planning model for financial behaviors outside of management’s control. This provides a reality check on business lines when their projections conflict with model outputs.

In short, examining more scenarios has very few downsides and many upsides.

About Empyrean

Empyrean is a balance sheet management system for the measurement and simulation of interest rate, liquidity, credit, and capital risks faced by financial institutions. The core of the system is Empyrean ALM™ which is the most efficient and intuitive analytic, forecasting, and simulation engine on the market. Large and mid-tier banks use Empyrean ALM™ to evaluate more balance sheet strategies across more scenarios than they can on any other system.

A single cash flow engine drives Empyrean ALM™ and an array of modules which extend core capabilities. The modules support liquidity stress testing, funds transfer pricing, deposit behavioral analytics, and credit risk analysis.

Empyrean achieves extraordinary speed and efficiency through its completely modern architecture developed using the Microsoft .NET Framework, giving the user the ability to install it in a multi‐user server environment.

About Steve Turner

He regularly presents and chairs industry risk conferences and is an invited speaker at FFIEC events. He has published in numerous industry journals including Bank Director, Bank Accounting and Finance, Commercial Lending Review, and American Banker.

Prior to joining Empyrean Solutions, Steve held Managing Director positions at Novantas and First Manhattan Consulting Group. He started his career leading treasury at Shawmut National Corporation, a leading Northeast regional bank now part of Bank of America. He has an undergraduate degree in economics from Allegheny College and an MBA in finance from Tulane University.

Want to learn more?

Stay connected with Empyrean’s latest insights and solutions

Join our community of financial institutions and get access to live webinars, comprehensive guides, best practices, and industry insights that will transform your institution’s risk and planning management processes.