TIMING ISN’T EVERYTHING, BUT IT IS IMPORTANT

If you are considering a new budgeting, planning, and forecasting tool to support your 2024 budget cycle, now is the time to start looking. Numerous factors must be accounted for when deciding to purchase and implement a new system. While the capabilities of the system to support the planning requirements for the organization are of paramount focus and importance, the significance that timing plays in the success of rolling out a new process and solution is critical. Many organizations wait too long to research, decide upon and implement a new system, putting significant pressure on their team(s) to rush through an implementation of the new application in order to meet the typical budget cycle deadlines, which ultimately leads to stress, burnout, shortcuts and other impediments to a successful roll out of the new system and process.

WORK BACKWARDS FROM THE START OF YOUR BUDGET PROCESS

When thinking about the purchase of a budgeting, planning, and forecasting tool, we strongly suggest working backwards from your targeted “Go-live” date to support the initial budgeting cycle. Then account for the following considerations when deciding when to begin your research and due diligence process:

Implementation and Training Process

Identify the amount of time needed for the implementation and training process, including consideration for the following items. As a best practice we recommend allotting between three to six months for the implementation and training phase of a new system.

- Setting up users, security, system access, etc.

- Identifying, capturing, and importing all needed data

- Setting up your institution’s hierarchies (chart of accounts, legal, and organizational hierarchies)

- Finance / Accounting setting up and seeding the budget with drivers and targets

- Finance / Accounting testing inputs and results before distributing for inputs

- “Contributor” (department, market, region line of business managers) inputs into the plan

- Working through final approval and adjustment processes

- Finance and Accounting teams learning all aspects of the system

- Training end users

- Items that may require more time for the implementation and rollout process:

- Difficulty in sourcing the required data in a quality state…especially if doing a cash flow-based balance sheet and margin planning process that requires instrument level loan, deposit, investment data, etc.

- Complexity of the organizational hierarchy and the need to set up alternate organizational roll-up structures for planning and reporting purposes

- Performing personnel / payroll planning at an employee level…requires additional data, security, and setup

- A decentralized budgeting approach…administrative setup, validation of drivers and seeded values prior to distribution, allotted time for managers to enter budget items, submission and approval processes, final adjustments, etc.

- Vacation and/or other time off factors for the primary administrators of the system

System Selection and Due Diligence Process

Consider the amount of time needed to work through the decisioning and contract processes for the new system. While your organization may not perform all these steps in the evaluation process, time should be appropriately allotted to any that will be done. Depending on which items will be included, and the focus and experience of the team, this typically takes between two to four months.

- Initial research to identify potential partner vendors

- Demonstrations and follow-up calls

- Reference calls

- Gathering and reviewing due diligence documents

- Technical review and approval

- Executive / Board approval

- Legal review and contract signing

- Items that may require more time for the system selection and due diligence process:

- Using an RFP (Request For Proposals)…need to consider the time it will take to identify, document and prioritize requirements and related questions, the time needed to send and allow for responses from potential vendors, the time needed to review responses in order to narrow list of vendors for presentations

- A structured procurement process…a defined procurement process, led by a procurement specialist can be extremely helpful, however, this usually requires more steps to work through, more considerations to account for and a more structured approval processes, all requiring more time in the evaluation and selection of a new solution

Based on our experience working with hundreds of financial institutions, we recommend:

- Beginning the evaluation process anywhere from Q2 to Q4 the year before you want to implement the new system

- With a decision being made between Q3 and Q4 of that year

- Starting the implementation of the new budgeting, planning, and forecasting tool in Q4 (prior year) to early Q1 (of the budget year).

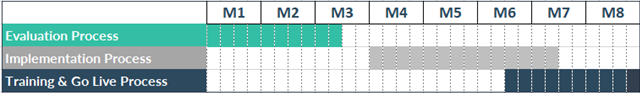

Sample Timeline to Evaluate, Implement and Go Live with a New Budgeting & Planning Solution