In the banking world, financial planning and analysis (FP&A) is no longer a budgeting task to be completed. It has evolved into a key part of strategic planning, utilized heavily to help finance leaders navigate challenging economic environments.

This includes volatility in interest rates, fluctuations in operational costs, and other overhead expenses. Meanwhile, finance leaders are still being required to adhere to regulatory and compliance requirements.

To stay competitive, smaller institutions like credit unions and community banks are looking to transform their FP&A functions to be more responsive and data-driven.

This post explores the top FP&A trends that are shaping the banking industry in 2026 and how finance leaders can adopt these methodologies to improve accuracy and profitability.

For an in-depth look at how lending institutions are managing risks in the modern business environment, explore Empyrean’s research on risk management statistics.

1. FP&A Becomes a Connected, Data-Driven Function

For lending institutions, FP&A has historically been kept separate from other teams and departments. In other words, functions like budgeting, asset liability management (ALM), and revenue and profitability analysis have typically been handled independently of one another.

However, without the ability to integrate and connect those functions, teams are less likely to be in alignment on strategic goals and directions. Starting in 2026, FP&A trends are leaning toward an inclusive data-driven approach to unite all teams and increase transparency.

According to Empyrean’s 2025 Bank Risk and Performance Survey results, 74% of institutions collaborate when it comes to having shared assumptions between ALM and planning. However, just 1 in 3 have the tools to fully integrate those processes.

That highlights the need for a unified platform that can allow teams to align on data, assumptions, results, and goals. Banks that succeed with that often report faster cycle times and greater levels of confidence in forecasts.

Empyrean’s Dataverse platform allows teams to work collaboratively under a shared data system in real time. It does so by combining data across budgeting and planning, ALM, and profitability.

With a single source of truth, consistency in assumptions and other data inputs is more easily achieved. This gives banks the ability to create forecasts with more accuracy and confidence. As a result, banks can plan and execute strategic business decisions more quickly in response to changes in the business environment.

Consider utilizing a guide on asset and liability management if your institution is looking for ways to improve balance sheet forecasting.

2. Automation Reduces Manual Work and Error Risk

As FP&A functions increasingly require more time, automation is key to ensuring tasks can be done quickly and more accurately.

FP&A processes heavily driven by manual functions are more prone to errors, such as those involving reporting, spreadsheet-driven workflows, and data collection flows. These are common pain points, as identified by Empyrean’s 2025 Bank Risk and Performance Survey.

The survey found that 35% of financial institutions reported budgeting and planning tools as the biggest challenge for FP&A functions.

FP&A trends for 2026 focus on automated tasks that streamline data management, such as gathering, processing, and reporting. Evaluating the data that has been collected can also be automated. This can include things like variance analysis, consolidation of budgets, and updated forecasts.

By minimizing manual bottlenecks and standardizing these processes, FP&A teams can spend less time compiling data for reports. Instead, they get to craft strategies in response to the insights provided.

From a regulatory standpoint, automation makes auditing much easier. Empyrean’s Budgeting and Planning suite of tools can help institutions of all sizes thanks to its configurable automations that save time from manually driven processes.

These automations also provide a high level of data integrity. The result is reduced time spent on day-to-day tasks and more accurate budgeting and forecasting processes.

Pro Tip: Focus automation on reconciliation and report generation first. It delivers the fastest return on investment (ROI) for lean teams.

3. Rolling Forecasts Replace Static Annual Budgets

Banks need the ability to quickly pivot in response to changes in rates, consumer behavior, loan demand, and more. To meet this need, banks have started replacing static, traditional forecasts with rolling forecasts. This allows them to make continuous updates to projections based on current market trends.

Empyrean’s 2025 Bank Risk and Performance Survey found that 29% of institutions generate forecasts quarterly, with 21% doing this monthly. Many still rely on static, unchanging annual budgets, which risk being outdated and inaccurate if markets experience drastic changes.

Rolling forecasts eliminate that risk by allowing banks to regularly update data inputs, assumptions, scenario testing, and data reconciliation.

Another added benefit of rolling forecasts is that it makes communication easier among teams like finance, risk, and compliance. This ultimately leads to a more complete view of how revenue and earnings might be impacted by market shifts.

Empyrean’s Budgeting and Planning Suite can help banks automate forecasts and ensure they utilize the most recent and relevant data.

Pro Tip: Link your rolling forecast directly to ALM assumptions to align liquidity and margin forecasts.

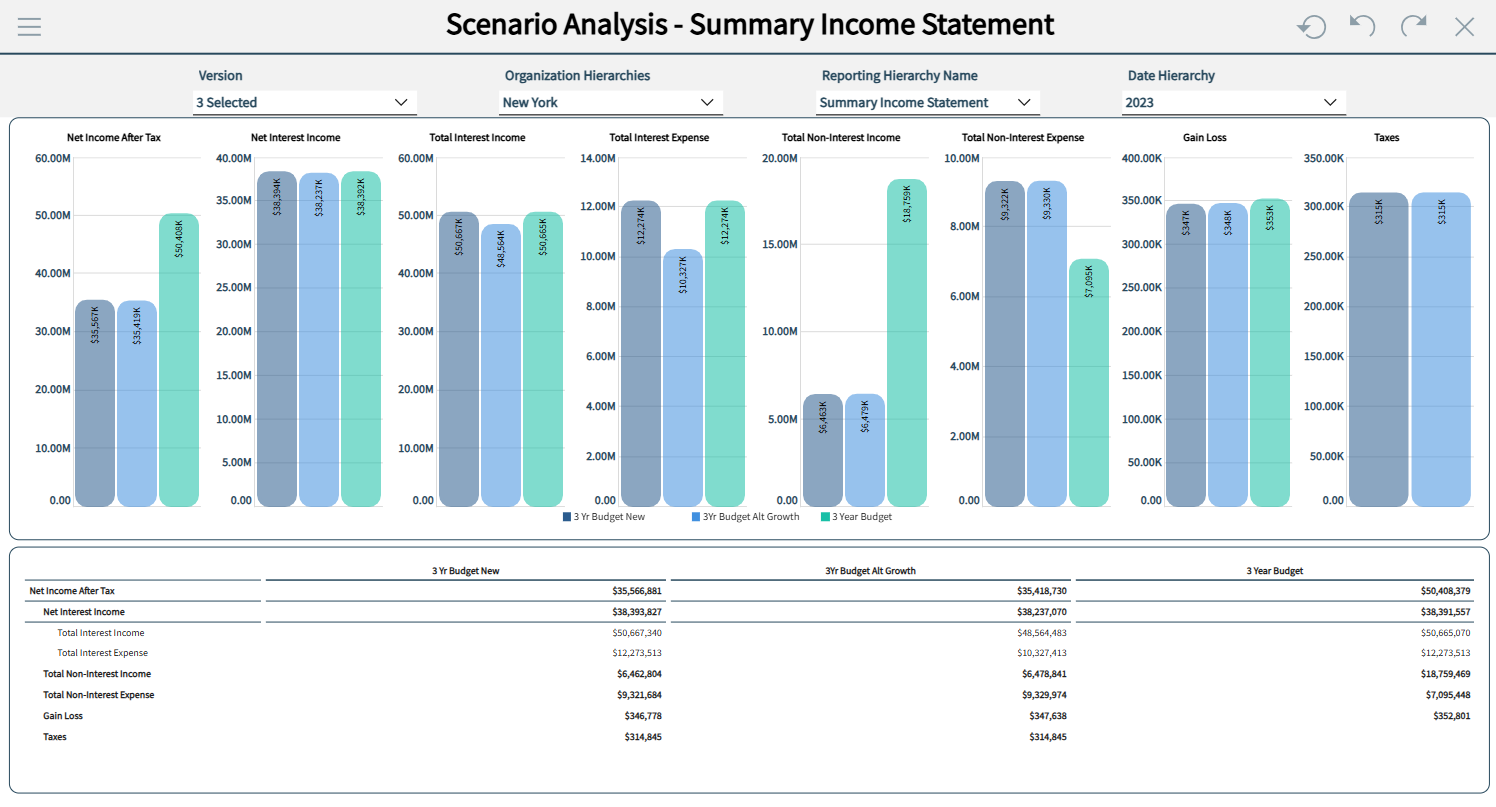

4. Scenario Planning Becomes Essential for Volatility Management

The speed at which the market can change makes static models inadequate for banks wanting to maximize profits. Rapid shifts in interest rates, deposit demands, and fluctuating loan trends are just some items that impact a bank’s bottom line. To stay on top of this, banks should use scenario planning.

Instead of analyzing and relying on a single forecast, finance leaders now consider multiple scenarios. This is done to determine how changes in various market characteristics could impact a bank’s liquidity and profitability.

Empyrean’s 2025 Bank Risk and Performance Survey shows that 67% of institutions already use some form of scenario analysis to prepare for quick and unexpected market shifts.

Doing so turns uncertainty into a potential strategic first-mover advantage and allows banks to move quickly should volatility arise.

While beneficial for banks of all sizes, it’s especially helpful for smaller credit unions and community banks. With more limited staffing and resources, they’ll more directly feel the time savings resulting from embedding scenario modeling into the planning cycle.

Empyrean’s integrated platform is perfect for this type of approach. This is because it allows institutions to model cash flow, rates, and revenue earnings scenarios alongside the same systems for budgeting and forecasting.

5. Profitability Analytics Drive Strategic Decision-Making

The FP&A role in many banks is shifting away from just managing expenses. Now, it also provides insights into profitability and its drivers. For example, it evaluates which locations, branches, customer types, products, or services generate the greatest margins.

Empyrean’s 2025 Bank Risk and Performance Survey reports a large gap when comparing what banks value and what is being measured.

Specifically, the report found that 86% of institutions view branch, product, and customer profitability as important. However, only 68% calculate it at those levels, with 24% not measuring profitability at all. Without understanding what drives those results, banks are at a high risk of inefficiently allocating time and resources and making the same mistakes they made in the past.

This analysis of profitability drivers gives FP&A teams the transparency necessary to tie results to strategic decisions. As a result, banks can proactively adjust business decisions and shape strategies for things like pricing, marketing, product, and compliance.

Here, Empyrean’s Profitability module can allow smaller banks to better optimize the use of company resources to be more aligned with short, medium, and long-term goals.

See Empyrean’s resource on bank profitability for additional insights.

Pro Tip: Pair profitability data with planning models to prioritize high-margin segments or branches.

6. Collaboration and Transparency Define Modern FP&A

FP&A planning is becoming more and more connected with other teams. Being able to work with finance, treasury, compliance, and risk is becoming an increasingly common arrangement.

Sharing data among departments with a single source of truth provides increased trust and confidence in forecasts and performance metrics. This allows decisions to be made more quickly and with more conviction.

Cloud-based FP&A models are key:

- Stakeholders can simultaneously access the same information. This minimizes errors and saves time that might result from a lack of version control.

- It can improve accountability across teams to ensure accuracy and consistency in the way data is handled.

- They can eliminate costs associated with on-site maintenance and are often associated with lower IT costs. This allows for a greater portion of the budget to be used elsewhere.

Empyrean’s cloud-based platform delivers all of this — collaboration and data governance. This allows teams to share data while maintaining a high level of documented changes for easier audit trails.

The outcome is a streamlined planning process that helps finance leaders make informed decisions without the need to make staffing changes.

7. FP&A Evolves from Reporting to Real-Time Decision Support

Financial reporting remains a crucial part of any bank. And, stakeholders will always require accuracy and transparency, whether it’s a board member, regulator, or third-party auditor.

FP&A is, however, shifting from more than just a static reporting role. It’s transforming into one that also delivers real-time insights guiding the future.

According to Empyrean’s 2025 Bank Risk and Performance Survey, 90% of institutions say their reporting is led by finance or accounting, with 52% depending on spreadsheets. The downside there is clear: the dependency inhibits the ability to quickly respond to volatile markets.

Banks looking to be more proactive use analytics that build on the current state of reporting. They’re tying historical results to real-time drivers of performance.

Analytics and performance dashboards allow finance leaders to monitor financial performance metrics as they evolve, rather than having to wait until the end of a reporting cycle.

Empyrean’s platform is well-suited to meet this need. Its modules for ALM, planning, and profitability all tie into a single unified environment that can be used for reporting.

Pro Tip: Modernize financial reporting templates first. Then, layer in dynamic dashboards to bridge historical accuracy and real-time analysis.

From Insights to Action: How Empyrean Helps

The newest FP&A trends highlight key changes finance leaders must make if they wish to remain competitive. Integrate systems, automate tasks, and have a forward-looking, proactive mindset.

Unfortunately, many smaller banks are limited from a resource perspective. They often rely on outdated tools that can’t factor in the nuances of the modern business environment. Common examples include manual spreadsheets and processes that make it difficult to react quickly in rapidly changing markets.

Empyrean bridges that gap with a platform that allows for real-time forecasts, rolling models, and driver-based planning. These capabilities help finance leaders get at the heart of what can improve a bank’s financial performance, especially in changing environments.

The Profitability and ALM modules take data from a bank’s branches and products and integrate forecasts into liquidity and risk management. Combined, those functions allow banks to navigate a new workflow with dynamic, real-time, and data-driven decision-making.

By combining forecasting, risk, and performance into a single platform, Empyrean helps banks handle the challenges of the modern business environment without the requirement to add to staffing or resourcing needs.

Ready to take the next step?

Discover how your lending institution can benefit from better accuracy and strategic decision-making with Empyrean Budgeting and Planning.

Empyrean Budgeting & PlanningFAQ: FP&A Trends in Banking

What Does FP&A Mean in Banking?

Financial planning and analysis (FP&A) is a process that combines aspects of budgeting, forecasting, and performance management. This is done to guide better business decisions.

Modern FP&A connects teams like finance, treasury, risk, and compliance through unified platforms like Empyrean’s Dataverse. This is to ensure every forecast and analysis is drawn consistently from the same sources of data.

Why Are Rolling Forecasts Important?

Rolling forecasts allow for adjustments to be made based on shifts in the business environment. Common examples could include changes in interest rates, deposit demand, and loan product trends.

Rather than being dependent on a static budget that does not change, Empyrean’s Budgeting & Planning module allows banks to conduct new forecasts on a more regular basis.

How Can Small Banks Modernize FP&A?

Small banks can modernize their FP&A processes by moving away from manual-driven processes. Instead, they should use cloud-based tools that integrate ALM, profitability, and budgeting.

Empyrean’s platform makes collaboration among teams seamless while cutting down on IT-related expenses. It also introduces automation, which eliminates the need to adjust staffing levels.

What Tools Help Automate FP&A?

Empyrean’s FP&A platform automates many aspects of forecasting, data analysis, and data management. This helps reduce errors while saving time, which allows teams to focus on other business initiatives.

Interested in learning more?

Discover how your lending institution can benefit from better accuracy and strategic decision-making with Empyrean.